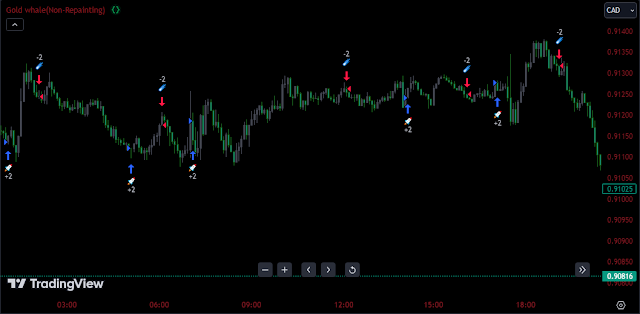

The Gold Whale (Non-Repainting) indicator is a custom-built trading tool designed to assist traders in identifying potential market movements, primarily within intraday trading sessions. Below, we analyze how this indicator functions, its strengths, weaknesses, and how traders can utilize it effectively in their strategies.

How It Works

The Gold Whale indicator uses mathematical functions, such as linear and hyperbolic tangent activation functions, to calculate data points derived from price movements over specific timeframes. It compares the difference between current and past price levels and determines percentage changes, which serve as inputs to complex neural network-like layers.

This computational method allows the indicator to detect patterns in price movements. It also includes features like:

- Intraday session filtering: Customizable trading session times (

0915-1450by default) ensure the indicator only generates signals during active trading hours. - Repainting toggle: An option (

disablerepainting) lets users decide whether the indicator should prioritize recalculating signals for accuracy. - Trade quantity input: Allows users to predefine their trade sizes for better money management.

Strengths

- Non-Repainting Logic: When the repainting option is disabled, the indicator ensures that signals do not adjust retroactively, improving reliability and reducing misleading signals.

- Intraday Focus: By targeting specific sessions, the indicator aligns better with short-term trading styles like scalping or day trading.

- Advanced Calculations: The use of activation functions and percentage-based movement detection provides a sophisticated approach to analyzing price behavior.

- Customization: Traders can adjust parameters like the threshold, sessions, and trade size, tailoring the tool to their specific needs.

Weaknesses

- Complexity of Calculations: The mathematical basis of this indicator can be challenging for novice traders to understand, making it less accessible to beginners.

- Performance Dependency: While sophisticated, the model’s effectiveness may vary across different markets or timeframes, requiring optimization for specific assets.

- Limited Historical Testing: The neural network-like approach might not perform well during unexpected market conditions, such as low liquidity or high volatility, without sufficient historical backtesting.

- Resource-Intensive: The intricate calculations can slow down performance on lower-end systems or during periods with large amounts of historical data.

How to Use the Gold Whale Indicator

- Set Parameters Carefully: Adjust the threshold and session times to match your preferred trading style and market conditions.

- Combine with Other Tools: Use it alongside other indicators, such as moving averages or RSI, for confirmation and reduced false signals.

- Disable Repainting for Clarity: When using the indicator for live trading, ensure the non-repainting mode is enabled to avoid any misleading results.

- Test Before Live Trading: Conduct thorough backtesting to evaluate its performance on your chosen asset and timeframe.

- Free download

Conclusion

The Gold Whale (Non-Repainting) indicator is a powerful tool with a unique methodology that appeals to advanced traders who understand its intricate design. While its strengths lie in its sophisticated calculations and flexibility, its complexity and market dependency mean that users must approach it with caution. By properly optimizing and testing the indicator, traders can harness its potential to improve their decision-making in the financial markets.