Strategy Components

1. Basic Indicator: Dynamic Gradient Oscillator (DGO)

The indicator calculates the ratio of the short-term moving average to the long-term moving average, with the option to use linear or logarithmic values. The result is represented as a dynamic line showing the relationship between short-term and long-term trends.

2. Moving Averages

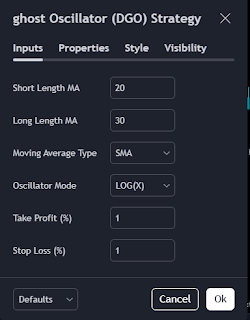

Short-term moving average: calculated based on a certain number of candles (default 20).

Long-term moving average: calculated based on a larger number of candles (default 30).

Two types of moving averages (SMA or EMA) are used depending on the user's preference.

3. Baseline

Represents a fixed reference line (1 in normal mode or 0 in logarithmic mode) to determine the indicator's intersections with trends.

How the strategy works

1. Entry and exit conditions

Buy signal: Issued when the indicator crosses the baseline from below to above. This indicates a positive shift in the short-term trend relative to the long-term trend.

Sell signal: Issued when the indicator crosses the baseline from top to bottom. This indicates a negative shift in the short-term trend.

2. Risk management

The strategy includes settings for risk management through:

Take profit: Setting the price level at which the trade will be closed once a specified percentage of profit is achieved (default 1.5%).

Stop loss: Setting the price level at which the trade will be automatically closed to avoid larger losses (default 1%).

Strategy features

Simplicity of settings and customization

The system allows users to choose the type of moving average (SMA or EMA) and the calculation method (linear or logarithmic).

Flexibility in adjusting the length of the moving averages to suit the nature of the financial instrument.

Effectiveness in all markets

The strategy can be used in stock markets, foreign exchange (Forex), cryptocurrencies, and even commodities.

Built-in risk management

The strategy provides built-in tools for setting take profit and stop loss levels, which helps protect capital.

Clear and uncomplicated signals

The strategy relies on direct buy and sell signals based on the intersection of the indicator with the baseline, making it easy to understand and implement.

Practical example

If you are trading on a currency pair like EUR/USD:

When the indicator (oscillator) crosses the baseline from bottom to top, a buy trade is opened.

The take profit level is set at 1.5% above the entry price, and the stop loss is set at 1% below the entry price.

If the market reverses before reaching the target, the stop loss is activated.

Possible disadvantages

Time lag in signals:

Due to the reliance on moving averages, signals may be delayed in highly volatile markets.

Need for experimentation and adjustment:

The strategy may require adjusting settings such as the length of the moving averages or the take profit and stop loss ratios to suit the target market.